Get the free walmart paperless pay talx

Show details

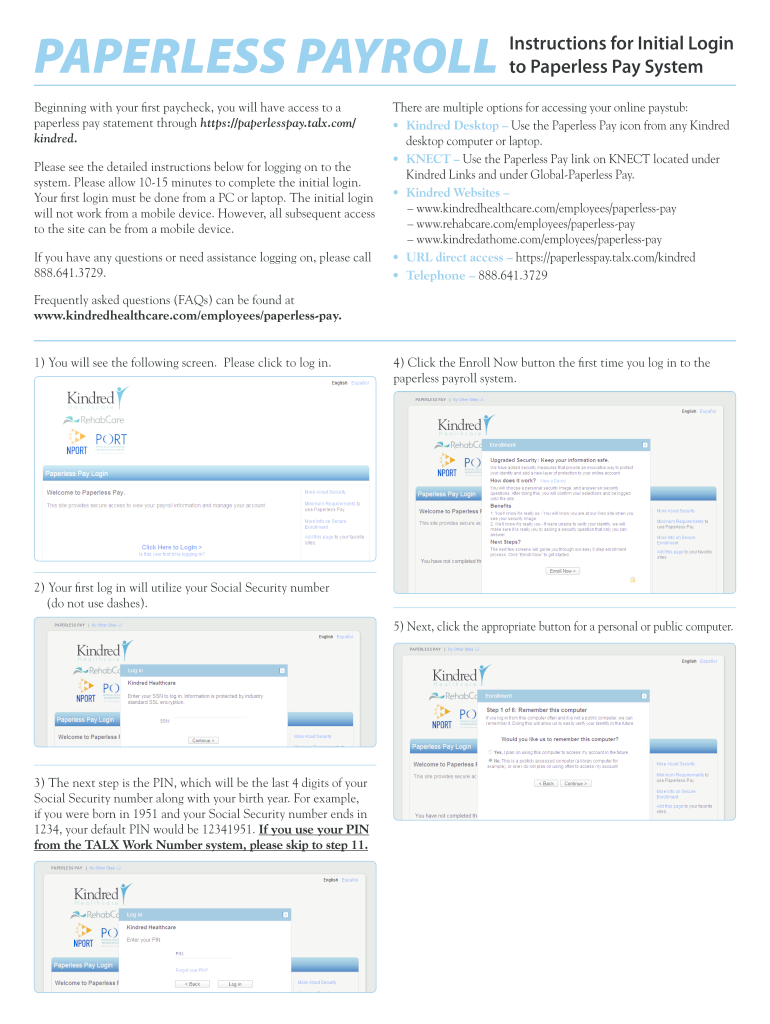

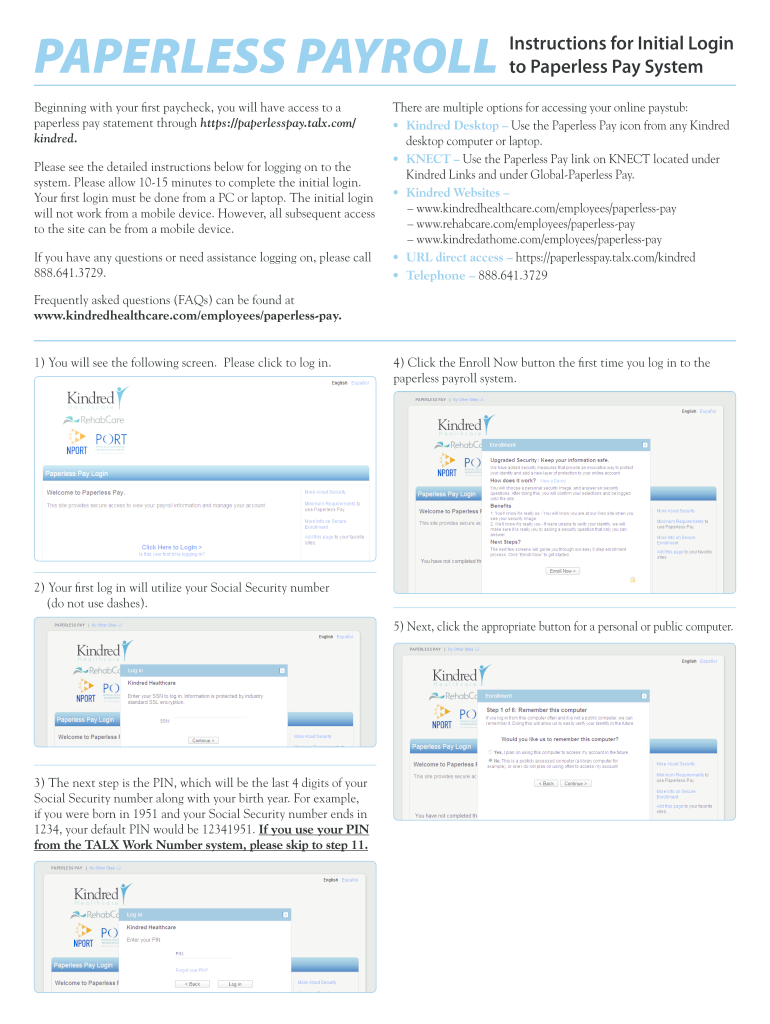

Kindred Websites www. kindredhealthcare. com/employees/paperless-pay www. rehabcare. com/employees/paperless-pay www. Kindredathome. com/employees/paperless-pay URL direct access https //paperlesspay. talx. com/kindred Telephone 888. 641. 3729. Instructions for Initial Login to Paperless Pay System There are multiple options for accessing your online paystub Kindred Desktop Use the Paperless Pay icon from any Kindred desktop computer or laptop. KNECT Use the Paperless Pay link on...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paperless pay talx login form

Edit your paperlesspay talx login form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paperless pay walmart form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit paperless pay login talx online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit talx paperless pay form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paperless pay talx form

How to fill out kindred paystub:

01

Start by gathering all the necessary information such as your personal details, including your name, address, and social security number.

02

Fill in the employer's information, including the company name, address, and contact information.

03

Enter the pay period dates, which typically indicate the start and end dates of the pay period for which the paystub is being generated.

04

Include your employee identification number, if applicable, as provided by your employer.

05

Input your total hours worked during the pay period, ensuring accuracy and correctness.

06

Enter your wage rate or salary, which can be an hourly rate or an annual salary depending on the pay structure.

07

Calculate your gross pay by multiplying your hours worked by your wage rate.

08

Deduct any applicable taxes, such as federal, state, and local taxes, from your gross pay.

09

Subtract other deductions, if any, like health insurance premiums or retirement contributions.

10

After deducting all applicable taxes and deductions, calculate your net pay, which is the final amount you will receive.

11

Double-check all the information provided to ensure accuracy and make any necessary adjustments.

12

Sign the paystub to certify the accuracy of the information provided.

Who needs kindred paystub?

01

Employees of Kindred or similar companies may require a kindred paystub to keep track of their earnings and deductions.

02

Employers may also require kindred paystubs to maintain accurate financial records for tax purposes and to provide documentation of income to their employees.

03

Government agencies, financial institutions, or lenders may request kindred paystubs as proof of income when applying for loans, housing, or other financial transactions.

Fill

paperlesspay talx

: Try Risk Free

People Also Ask about paperless talx sign in

What is the PIN number for Walmart paperless pay?

Your PIN# is your current earnings from your most recent paycheck stub. If you do not have your most recent pay stub, see your Personnel or Location Manager to obtain information from the most current payroll register. NOTE: Do NOT give the 1-800-367-2884 phone number to verifiers.

How do I set up paperless pay at Walmart?

Under "Account Services & Settings" click on the "Paperless" option. You must have a valid email address associated with your account in order to activate this feature.

What is paperless pay?

What is paperless pay? With paperless pay, businesses complete all forms of payment online rather than on paper. Employees can conveniently access payment-related information online and receive paychecks by direct deposit.

What is a paperless pay stub?

Paperless payroll software allows employers to process payroll and manage all aspects of paying employees electronically. Paperless services also allow employees to access payroll-related information like pay stubs, W-2s, and time cards.

How do you use paperless pay?

With a paperless paycheck process, your employees are paid through direct deposit. They input their bank account information once into the online portal which automatically verifies the bank account information. Once verified, the employee's payment distributes directly into their account on a scheduled basis.

What is PIN in paperless pay?

The default PIN is the last four digits of your social security number and the four digit year of birth. You will be asked to change your PIN after the initial login. Click Here to Login >

How do I access my paystub?

Ask your employer where you can find your pay stub Ask your manager or the human resources department where you can locate them electronically. Typically, companies who house them electronically have them on a payroll service website which requires an employee login and password.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the paperless pay zf talx in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your paperless pay gpi talx login and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit paperlesspaytalx com on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share paperlesspay talx sign in from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete paperless pay talx sign in on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your https paperlesspay talx com, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your walmart paperless pay talx online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Paperless Talx is not the form you're looking for?Search for another form here.

Keywords relevant to paperlesspaytalx

Related to kindred paystub login

If you believe that this page should be taken down, please follow our DMCA take down process

here

.